In recent years, AgriTech startups have emerged as key players in transforming the agricultural sector through technological innovation. These startups, backed by chartered venture funds, are pushing the boundaries of traditional farming by introducing advanced solutions that enhance productivity, sustainability, and supply chain efficiency. As global demand for food grows and environmental challenges intensify, AgriTech startups supported by strategic funding have become instrumental in shaping the future of agriculture.

Understanding the Role of Chartered Venture Funds in AgriTech Startups

Chartered venture funds are specialized investment entities regulated by financial authorities to support startups and early-stage companies. These funds have gained significant interest in the AgriTech space because they offer both capital and strategic expertise tailored to the unique needs of agricultural technology ventures. By backing AgriTech startups, these venture funds help accelerate innovation that addresses critical challenges such as crop yield optimization, resource management, and climate resilience.

Chartered venture funds bring more than just financial resources to AgriTech startups; they provide mentorship, industry connections, and market access, which are crucial for young companies to scale effectively. This relationship enables startups to move faster from proof-of-concept to market-ready solutions.

How AgriTech Startups are Revolutionizing Agriculture

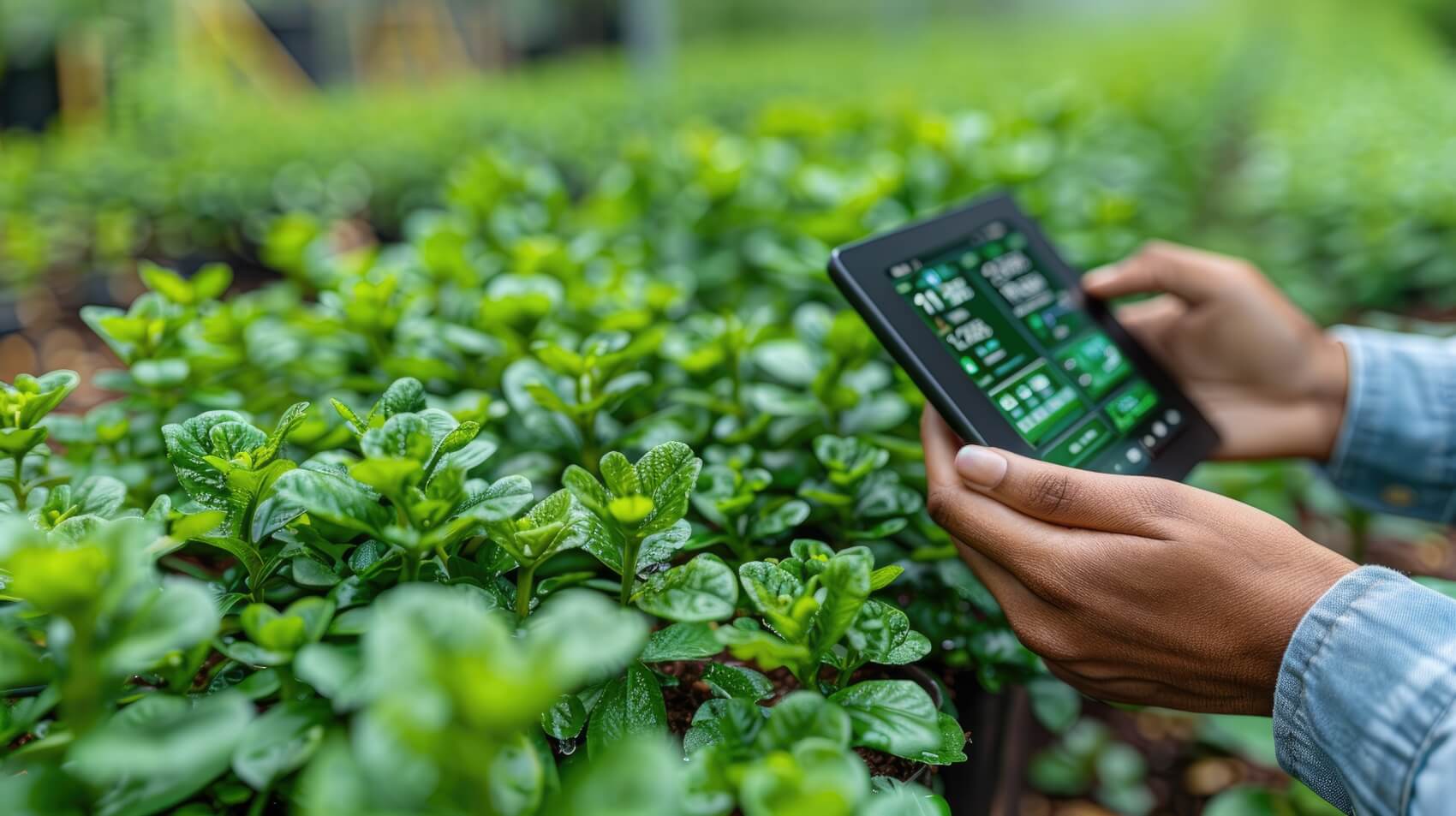

AgriTech startups are leveraging a variety of technologies, including artificial intelligence, Internet of Things (IoT), drones, robotics, and blockchain to transform agriculture. Some of the key areas these startups focus on include:

- Precision Farming: Using data-driven insights to optimize planting, irrigation, and fertilization, thus reducing waste and improving yields.

- Supply Chain Transparency: Blockchain-enabled tracking systems improve traceability and reduce fraud in agricultural products.

- Sustainable Agriculture: Innovations aimed at minimizing environmental impact by reducing water usage, pesticide application, and carbon footprint.

- Farm Management Software: Integrated platforms help farmers monitor operations, predict outcomes, and manage resources more efficiently.

The involvement of chartered venture funds allows these startups to invest in research and development, pilot projects, and commercial expansion, leading to faster adoption of these technologies in the field.

Key AgriTech Startups Backed by Chartered Venture Funds

Several AgriTech startups have gained momentum thanks to investments from chartered venture funds. For example:

- AgroSense: Focuses on precision agriculture using AI to analyze soil and crop health.

- FarmLink: Uses blockchain to create transparent and fair marketplaces for farmers and buyers.

- GreenGrow: Develops sustainable vertical farming systems to enable urban agriculture.

- DroneFarm: Provides drone services for crop monitoring and spraying.

These startups exemplify how chartered venture funds can identify promising ventures and provide them with the capital and resources needed to scale operations.

Why Chartered Venture Funds Prefer Investing in AgriTech Startups

Investors see AgriTech startups as lucrative opportunities due to several reasons:

- Growing Market Demand: With increasing global population and food security concerns, there is an urgent need for innovative agricultural solutions.

- Technological Advancements: Rapid progress in AI, IoT, and biotech creates new possibilities for efficiency gains.

- Sustainability Focus: Governments and consumers are pushing for environmentally responsible farming practices.

- Potential for Impact: AgriTech startups have the capacity to transform rural economies and improve livelihoods.

Chartered venture funds, often with mandates to promote sustainable and impactful investments, find AgriTech an attractive sector aligned with their objectives.

Challenges Faced by AgriTech Startups and How Venture Funds Help Overcome Them

Despite the potential, AgriTech startups face unique challenges such as:

- Vysoké kapitálové požadavky: Technology development and field trials are costly.

- Long Sales Cycles: Farmers and agricultural enterprises may be slow to adopt new technologies.

- Regulační překážky: Compliance with agricultural and environmental regulations can be complex.

- Market Fragmentation: Diverse farming practices and regional differences make scalability challenging.

Chartered venture funds mitigate these challenges by offering not only funding but strategic guidance, networking opportunities, and advocacy support. This comprehensive backing helps startups navigate complexities and build sustainable business models.

How Chartered Venture Funds Drive Innovation in AgriTech Startups

Chartered venture funds actively foster innovation in AgriTech startups by:

- Encouraging cross-sector collaboration between technology experts and agricultural scientists.

- Supporting pilot projects that validate new technologies under real farming conditions.

- Facilitating partnerships with research institutions, government bodies, and large agricultural companies.

- Providing flexible capital structures that accommodate long development cycles common in AgriTech.

These efforts create an ecosystem where innovative ideas can evolve into scalable solutions that benefit farmers worldwide.

The Future Outlook for AgriTech Startups Backed by Chartered Venture Funds

The future looks promising for AgriTech startups supported by chartered venture funds. As climate change intensifies and demand for sustainable food systems grows, these startups will play a vital role in addressing global agricultural challenges. Increased funding, policy support, and technological breakthroughs are expected to accelerate the adoption of AgriTech solutions.

Moreover, digital transformation in agriculture will likely expand beyond production to include logistics, financing, and insurance, creating new opportunities for startups and investors alike. Chartered venture funds will continue to be key enablers in this journey by providing the capital and expertise necessary for innovation and scale.

Závěr

AgriTech startups backed by certifikované fondy rizikového kapitálu are at the forefront of revolutionizing agriculture through technology and innovation. These funds not only supply essential financial resources but also provide strategic support that helps startups overcome industry-specific hurdles. With their combined efforts, the future of agriculture looks more sustainable, efficient, and resilient. As these startups grow, they hold the promise to significantly improve food security and environmental outcomes worldwide.

Komentáře