Google Still Needs to Convince Investors It Has Got the Hang of AI

Despite its pioneering role in artificial intelligence, Google faces mounting pressure from investors who remain unconvinced that the tech giant has fully capitalized on its AI leadership. With competitors like Microsoft and OpenAI surging ahead in public perception and practical AI deployment, Alphabet Inc. — Google’s parent company — must do more than showcase demos. It must prove AI delivers bottom-line growth.

As AI reshapes everything from search to cloud computing, investors are scrutinizing Google’s AI strategy like never before. While the company has made strides with tools like Gemini (formerly Bard) and its integration of AI into Google Workspace and Search, Wall Street wants concrete results.

In this article, we explore why Google still hasn’t convinced investors of its AI prowess, what’s at stake for Alphabet, how it compares to rivals like Microsoft, and what it must do next to maintain market dominance in the AI era.

Google’s AI Reputation: Strong Legacy, Mixed Execution

Google has long been considered an AI research powerhouse. From DeepMind’s AlphaGo victory to the foundational Transformer architecture behind ChatGPT, Google has developed many of the building blocks of today’s AI explosion.

But despite this legacy, the company has often been criticized for failing to commercialize its AI breakthroughs as effectively as others. While OpenAI and Microsoft swiftly moved to deploy AI in products, Google appeared more cautious — or, as critics argue, tentative and reactionary.

Key concerns include:

- Late launches: Bard and Gemini lagged behind ChatGPT in market awareness.

- Underwhelming product demos: Several AI launches have been met with criticism or technical glitches.

- AI safety debates: Internal conflicts over responsible AI practices may have slowed development.

Investors Want AI to Drive Revenue, Not Just Headlines

Google’s AI efforts are broad — touching everything from Google Search and YouTube to Google Cloud and Ads. Yet investors are increasingly focused on revenue impact, not research accolades.

Here’s what investors want to see:

- Search monetization: Will AI summaries in Search boost or cannibalize ad revenue?

- Cloud growth: Can Google Cloud’s AI services compete with AWS and Azure?

- AI enterprise tools: Will AI-powered Workspace apps (Docs, Gmail) drive upsells?

- Cost efficiency: Is AI streamlining operations or increasing expenses?

Without clear KPIs showing that AI is improving margins, gaining market share, or increasing user engagement, shareholders may remain skeptical.

Microsoft’s Advantage: First-Mover and Market Execution

Perhaps no company has benefited more from the AI hype cycle than Microsoft, thanks to its $13 billion investment in OpenAI and rapid integration of ChatGPT into Bing, Office 365, and Azure.

Microsoft’s narrative is simple and sticky: AI equals growth. Whether it’s GitHub Copilot driving developer productivity, or Azure’s surging cloud AI revenues, Microsoft has delivered a compelling, revenue-backed AI story.

Compared to Microsoft, Google faces:

- A weaker AI narrative in enterprise SaaS

- Slower enterprise adoption of Gemini AI products

- Lower visibility of monetizable AI features

This perception gap is what Google must now close — not just with announcements, but with evidence of real-world business impact.

Gemini and Google Search: The Double-Edged Sword

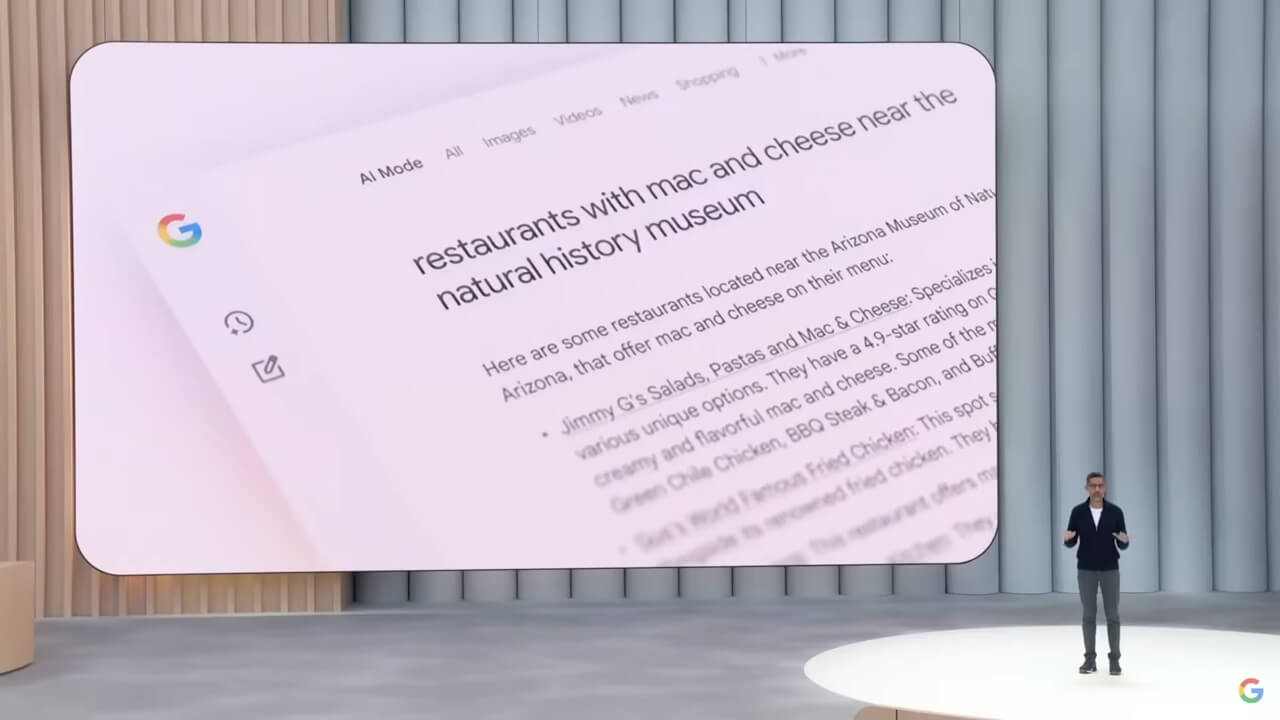

One of Google’s most high-profile AI experiments is Search Generative Experience (SGE), now rolling out under the Gemini branding. It uses generative AI to summarize answers directly in Search results, reshaping how users interact with queries.

But here’s the catch: If users find answers within the AI summary, they may never click on ads or websites — potentially hurting Google’s core advertising business, which generated over $240 billion in revenue last year.

Investor questions include:

- Will AI reduce or increase ad impressions?

- Can AI-generated results be monetized effectively?

- How does Google balance user satisfaction vs. monetization?

Until Google proves that AI-powered Search enhances revenue — not shrinks it — this remains a high-stakes experiment.

Google Cloud and AI: A Growing Opportunity

One area where Google is seeing AI-driven success is in Google Cloud, particularly its Vertex AI platform and AI-specific infrastructure like TPUs (Tensor Processing Units).

Key AI cloud offerings include:

- Generative AI development platforms

- AI-powered data analytics tools

- Pre-trained models for enterprises

During the last earnings call, Google Cloud posted double-digit growth, with AI cited as a “key driver of customer interest.” However, compared to Microsoft Azure, Google Cloud still trails in market share and enterprise penetration.

Investors want to see Google Cloud AI transition from R&D showcase to revenue engine — especially as AI workloads demand massive infrastructure.

AI in YouTube, Gmail, and Google Docs: Incremental, Not Game-Changing

Beyond Search and Cloud, Google has integrated AI into consumer and productivity products. Gmail and Docs now feature “Help Me Write”, while YouTube uses AI for summarization, content moderation, and personalized recommendations.

Yet these features, while useful, are seen as incremental enhancements — not revolutionary revenue generators. The challenge for Google is to productize AI in a way that creates upsell opportunities ve boosts platform engagement at scale.

The Role of Regulation: A Wildcard for Google’s AI Future

As a global tech leader, Google operates under heavy scrutiny. Antitrust lawsuits, privacy regulations, and AI safety concerns all complicate its ability to innovate freely.

Current regulatory risks include:

- U.S. Department of Justice antitrust cases

- EU AI Act implications

- Heightened scrutiny of AI-generated content (disinformation, bias, etc.)

These pressures may partially explain Google’s cautious AI rollout compared to more aggressive competitors. But investors may interpret this caution as a lack of decisiveness, adding to concerns about long-term dominance.

Can Google Reclaim the AI Narrative?

Despite skepticism, it’s far too early to count Google out. The company has massive advantages:

- Unparalleled data access across search, maps, video, and email

- World-class AI research teams (DeepMind, Google Brain)

- Control of Android OS, enabling mobile AI integration at scale

- A global brand trusted by billions of users

To win over investors, Google must now translate these assets into a coherent and measurable AI business strategy.

What Google Must Do to Convince Investors

To rebuild investor confidence, Google should take the following steps:

1. Report Specific AI KPIs

Rather than vague AI mentions on earnings calls, Alphabet must break out:

- Revenue directly attributable to AI products

- AI-driven advertising performance improvements

- Enterprise adoption rates of Gemini in Workspace and Cloud

Transparency will help reshape the narrative.

2. Showcase Use Cases That Drive ROI

From healthcare and finance to media and education, Google should highlight high-impact case studies where AI tools deliver measurable business value.

3. Improve Gemini’s Competitive Position

Gemini (formerly Bard) must not only match ChatGPT — it must surpass it in usability, integration, and output quality. Google’s multimodal AI strength should be better demonstrated to users and developers alike.

4. Accelerate AI Partner Ecosystem

Google needs to aggressively grow partnerships with SaaS companies, app developers, and cloud-native firms who build on its AI stack — creating network effects and developer loyalty.

5. Balance AI Ethics With Innovation

Investors respect responsible AI. But delays or watered-down products due to internal ethical debates may undermine confidence. Google must clearly communicate how it balances AI safety with market speed.

Final Thoughts: The Clock Is Ticking

Alphabet remains one of the most resource-rich and technically advanced companies on the planet, but in the AI race, perception matters just as much as capability.

Right now, Google is battling a narrative crisis. Despite its deep roots in AI innovation, many investors view it as slow, reactive, and at risk of losing leadership. To fix that, Google needs to shift from AI potential to AI performance.

If it can deliver measurable outcomes, reinforce its brand as the AI backbone of the internet, and out-execute rivals in cloud and consumer AI, Google may yet reassert itself as the king of the AI economy.

But until then, Wall Street remains unconvinced — and the pressure is on.

Google Baskı Altında: Yatırımcılara Yapay Zeka Liderliğini Kanıtlayabilir mi?">

Google Baskı Altında: Yatırımcılara Yapay Zeka Liderliğini Kanıtlayabilir mi?">

Yorumlar