Michael Sixt is an accomplished financial journalist specializing in innovative startup financing and growth strategies. With a deep understanding of Consumer Value Finance (CVF) and modern venture funding frameworks, Michael has extensively covered how startups leverage CAC as new CapEx and EBITCAC as transformative financial metrics.

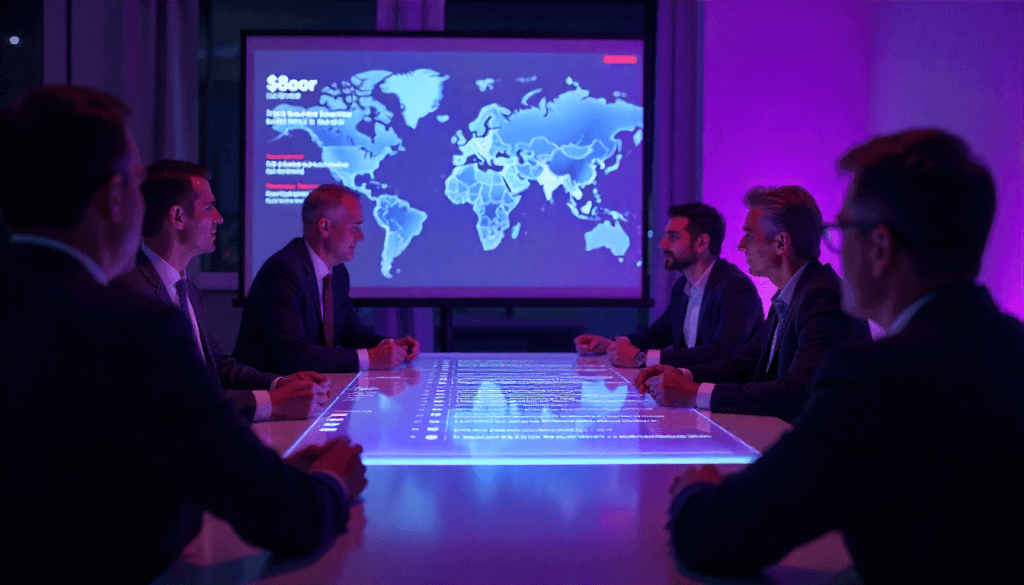

His insightful analyses and compelling narratives regularly appear in prominent business and technology publications, shedding light on how cutting-edge financing methods reshape the investment landscape across the US, UK, and EU. Michael has built a reputation for clear, precise, and actionable journalism, helping founders, investors, and executives understand and implement CVF strategies effectively.

Holding degrees in Economics and Journalism, Michael blends rigorous financial expertise with engaging storytelling. His thought leadership and interviews with industry innovators have made him a trusted voice in startup communities, venture capital circles, and fintech ecosystems globally.